FinOps—short for Financial Operations—a groundbreaking approach that merges financial management with cloud operations. FinOps empowers organizations to optimize their cloud spending in real-time, fostering a collaborative environment where finance, operations, and engineering teams work together to achieve financial transparency and accountability. This article explores the evolution, core principles, lifecycle, and future of FinOps, providing insights into how this practice can transform cloud cost management and drive business success.

TL;DR

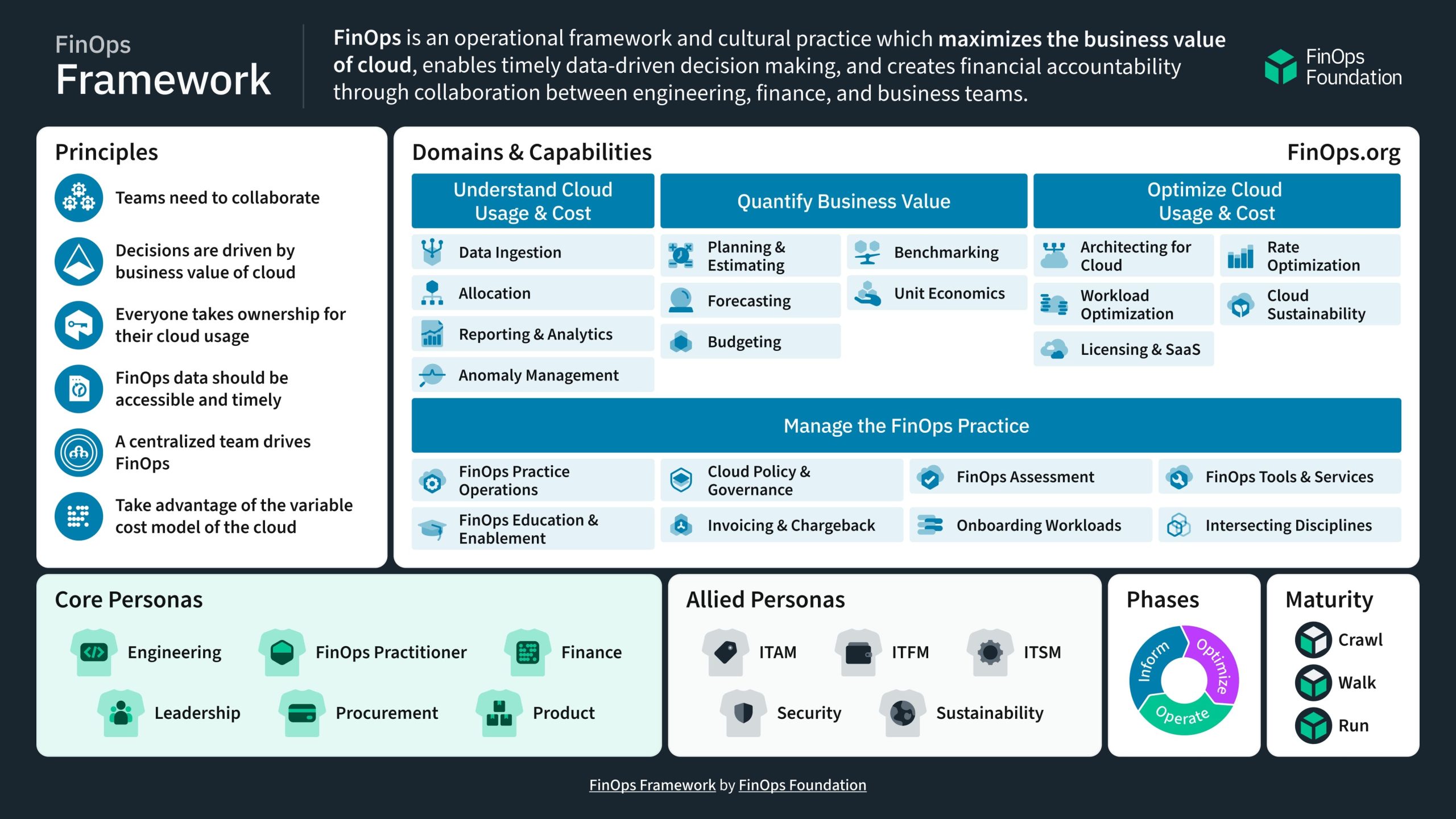

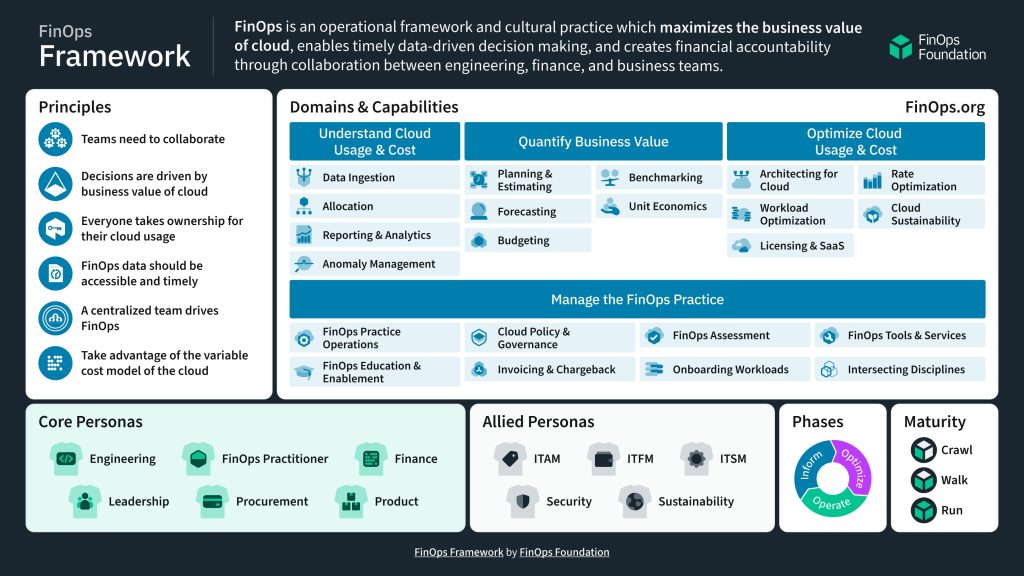

FinOps, or Financial Operations, is a modern approach that combines financial management with cloud operations to optimize cloud costs. It emphasizes financial accountability, collaboration across teams, and a balance of centralized control with decentralized execution. The FinOps lifecycle includes the Inform, Optimize, and Operate phases, each focused on monitoring, analyzing, and managing cloud expenses.

The benefits of FinOps include cost efficiency, improved financial visibility, and better decision-making. Despite challenges like cultural barriers and complex cloud environments, FinOps offers a framework for continuous improvement and leveraging technology to manage cloud costs effectively.

What is FinOps?

FinOps is a practice that combines financial management and cloud operations to ensure efficient and effective utilization of cloud resources. This approach involves real-time monitoring, management, and optimization of cloud expenditures, fostering a collaborative environment where finance, operations, and engineering teams work together to achieve financial accountability and transparency.

Financial operations have significantly evolved with the advent of cloud computing. Traditional financial management practices, designed for on-premises infrastructure, struggled to keep pace with the dynamic and scalable nature of cloud services. This gap necessitated a new approach—FinOps—to manage cloud costs and drive value.

Today, where cloud adoption is ubiquitous, FinOps plays a crucial role in controlling costs and maximizing ROI. It helps organizations maintain financial discipline while scaling their cloud infrastructure, ensuring they can innovate and grow without overspending.

What Are The Core Principles of FinOps?

Financial Accountability

At the heart of FinOps is financial accountability. This principle emphasizes that every team member, from engineers to executives, is responsible for understanding and managing cloud costs. By promoting a culture of accountability, organizations can avoid unnecessary expenses and make more informed financial decisions.

Collaboration Between Teams

FinOps thrives on collaboration. It breaks down silos between finance, operations, and engineering teams, encouraging them to work together towards common financial goals. This collaborative approach ensures that financial strategies align with technical and business objectives.

Centralized Control with Decentralized Execution

FinOps advocates for a centralized control framework that provides oversight and governance, while allowing decentralized execution. This means that while the overall financial policies and strategies are set at the top, individual teams have the flexibility to manage their cloud resources within those guidelines.

FinOps Lifecycle

Inform Phase

The FinOps lifecycle begins with the Inform phase, where the focus is on gathering data and providing visibility into cloud spending. This phase involves setting up dashboards, reports, and alerts to help teams understand their cloud costs and usage patterns.

Optimize Phase

Next is the Optimize phase, where teams analyze the data collected during the Inform phase to identify opportunities for cost savings. This includes rightsizing resources, eliminating waste, and leveraging discounts or reserved instances.

Operate Phase

The final phase, Operate, involves implementing the optimizations and continuously monitoring cloud usage to ensure sustained efficiency. This phase also includes periodic reviews and adjustments to keep cloud costs under control as business needs evolve.

Benefits of Implementing FinOps

Cost Efficiency

One of the primary benefits of FinOps is cost efficiency. By continuously monitoring and optimizing cloud expenditures, organizations can significantly reduce their cloud costs without compromising on performance or scalability.

Improved Financial Visibility

FinOps provides improved financial visibility, allowing organizations to track and understand their cloud spending in real-time. This transparency helps in making data-driven decisions and identifying potential cost overruns before they become problematic.

Enhanced Decision Making

With FinOps, decision-making is enhanced through accurate and timely financial data. Teams can make better-informed choices about resource allocation, scaling, and budget planning, leading to more strategic and efficient operations.

FinOps Framework

The FinOps Team Structure

A successful FinOps implementation requires a well-defined team structure. This typically includes roles such as FinOps practitioners, cloud engineers, finance analysts, and executive sponsors. Each role has specific responsibilities, ensuring comprehensive coverage of financial operations.

Key Metrics and KPIs

To measure the success of FinOps initiatives, organizations rely on key metrics and KPIs. These may include cost per transaction, cloud spend as a percentage of revenue, and utilization rates of reserved instances. Tracking these metrics helps in assessing performance and identifying areas for improvement.

Tooling and Automation

Tooling and automation are essential components of FinOps. Automated tools for monitoring, reporting, and optimization help in managing cloud costs efficiently. Popular tools include AWS Cost Explorer, Google Cloud’s Cost Management tools, and Azure Cost Management and Billing.

Challenges in FinOps

Cultural Barriers

One of the significant challenges in implementing FinOps is overcoming cultural barriers. Shifting from a traditional financial management approach to a collaborative FinOps model requires a change in mindset and processes, which can be difficult to achieve.

Complexity in Cloud Environments

Cloud environments are inherently complex, with multiple services, pricing models, and usage patterns. Managing this complexity requires a deep understanding of cloud platforms and continuous effort to stay updated with the latest developments.

Data Accuracy and Accessibility

Accurate and accessible data is critical for FinOps success. Inaccurate or incomplete data can lead to incorrect decisions and missed opportunities for optimization. Ensuring data accuracy and accessibility involves setting up reliable data collection processes and tools.

Best Practices for FinOps

Establishing a FinOps Culture

Creating a FinOps culture involves fostering a mindset of financial accountability and collaboration. This can be achieved through regular training, clear communication of financial goals, and incentivizing cost-saving initiatives.

Continuous Improvement

FinOps is not a one-time project but an ongoing process of continuous improvement. Regularly reviewing and refining financial strategies, staying updated with cloud pricing changes, and adopting new tools and practices are essential for sustained success.

Leveraging Technology and Tools

Leveraging the right technology and tools is crucial for effective FinOps. Automation tools, cost management platforms, and advanced analytics can significantly enhance the ability to monitor, manage, and optimize cloud expenditures.

The future of FinOps is shaped by emerging trends and technologies. Increased adoption of multi-cloud strategies, the integration of AI and machine learning, and the growing importance of sustainability in cloud operations are some of the trends expected to influence FinOps.

AI and machine learning are set to play a significant role in the future of FinOps. These technologies can enhance data analysis, automate routine tasks, and provide predictive insights, leading to more efficient and proactive financial management.

Conclusion

By embedding financial accountability across all levels, encouraging interdepartmental collaboration, and adopting a framework of continuous optimization, organizations can not only manage their cloud expenses more effectively but also enhance overall operational efficiency. The journey of integrating FinOps within an organization is continuous and evolving, necessitating a commitment to cultural adaptation and technological advancement. As cloud technologies continue to evolve, so too will the strategies and tools associated with FinOps, ensuring that organizations remain agile, financially sound, and technologically adept.

If you’re ready to optimize your cloud operations and foster a culture of financial accountability within your organization, reach out to us at Costwise.Cloud. We specialize in FinOps enablement, providing the expertise and tools necessary to guide you through every phase of your FinOps journey. Contact us today to learn how we can help you achieve cost efficiency and operational excellence.